It is self-evident that changes in technology lead to major changes in work patterns and our lives in general. With the start of a new year it is a good time to reflect on how SAM will be affected with the onset of new technologies. The likelihood is that SAM will still exist but not as we know it. This article provides some predictions that will affect everyone in the ITAM/SAM industry.

Currently SAM is dominated by compliance. This means the industry is geared to measuring, identifying and analysing the number of software deployments compared to licenses purchased. The reason for this is simple, licensing agreements generally state that if software is deployed to a device or user then it has to be paid for regardless of what is used. The licensing rules are enforced by software companies’ rights to audit deployments of their software. If an organization is non-compliant they have to pay the amount owed (usually un-budgeted) and in some case fines. However this focus on compliance is changing and SAM managers will need to shift their focus to respond.

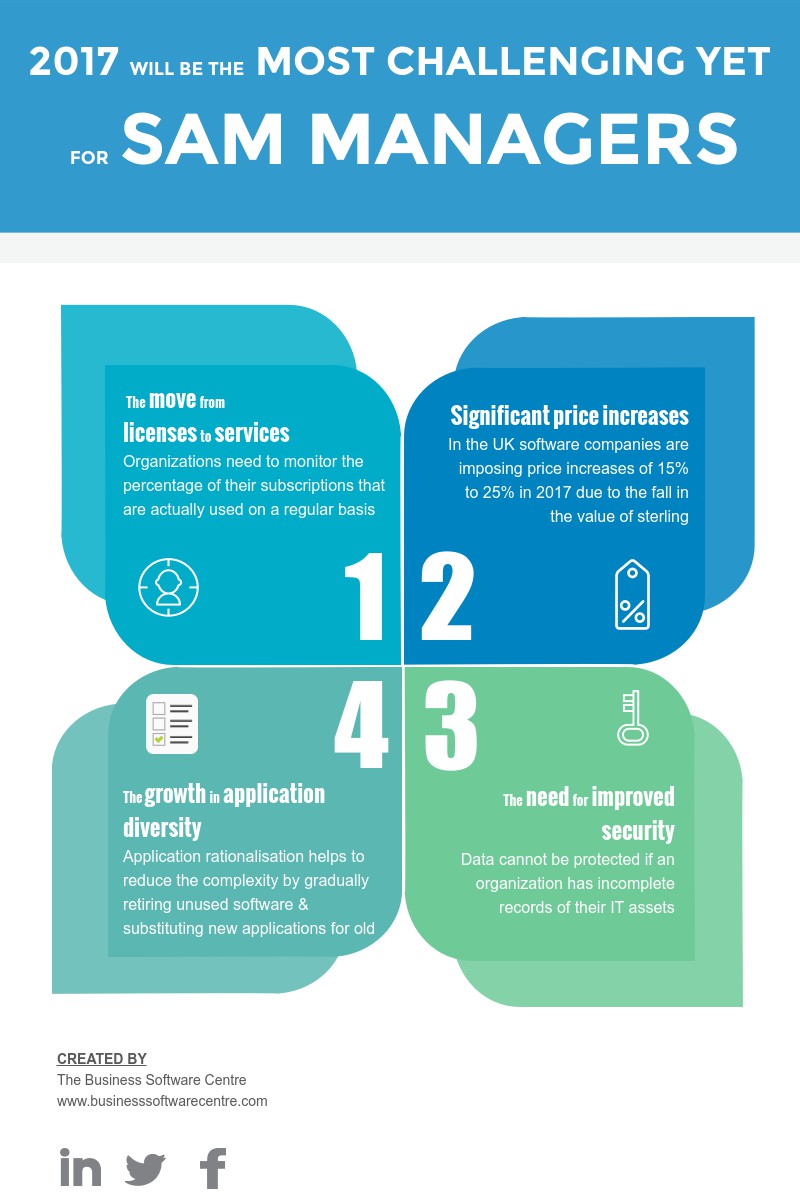

2017 will be the most challenging yet for SAM Managers

The key challenges for SAM Managers are:

- The move from licenses to services. Software companies now want subscriptions for services not just license revenue. Recurring revenue streams provide them with a more secure and lower cost business model than selling licenses and upgrades. In the last recession those software companies with SaaS models fared far better than those with the traditional licensing models because users can postpone new or upgrade installs but cannot cancel subscriptions if this means cutting off key business applications. Subscriptions mean compliance is largely irrelevant but cost efficiency based on usage metering becomes all important. Clearly organizations need to monitor the percentage of their subscriptions that are actually used on a regular basis. If the SAM function doesn’t do this the Finance function will.

- Significant price increases. In the UK software companies are imposing price increases of 15% to 25% in 2017 due to the fall in the value of sterling. Other pressures such as the continuous growth in sales targets will mean further price increases for vendors in mature market segments. All of this will require an increased focus on value for money and cutting waste. Usage metering and accurate inventory management will become the prime focus rather than compliance. If the SAM function does not manage this aspect then the Procurement function will.

- The need for improved security. Increased security threats and changes in legislation (e.g. GDPR) means that knowing what devices are in use, where they are and what applications are running becomes paramount. Data cannot be protected if an organization has incomplete records of their IT assets. IT asset managers will need to provide 100% accuracy of their inventories or else the Security community will.

- The growth in application diversity. Every year new software applications are launched and organizations add them to their software portfolios. For the SAM manager this means increased complexity as the number of applications grow. In most cases older legacy applications remain in the range of software to be managed so the diversity increases causing what is known as “the long tail”. Application rationalisation will help to reduce the complexity by gradually retiring unused software and substituting new applications for old. Without this type of process, user support and service becomes a major problem. If SAM managers do not respond to this issue then the Service community will.

In summary, software asset management is changing radically. The future needs of organizations will change from licensing compliance to efficient management of applications. The SAM managers of today face a choice, either change focus to become software efficiency managers or be prepared to let other functions take over the management of software applications.